If you’re in the market for a new home, you may be tempted to wait for prices to drop before making a purchase. It’s understandable to want to save money, but waiting for lower prices might not be the best strategy. Here are a few reasons why:

First, home prices are notoriously difficult to predict. While it’s true that prices can fluctuate based on supply and demand, interest rates, and other economic factors, it’s hard to know when and how much prices will change. You might end up waiting for a long time, only to find that prices have actually increased.

A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.”

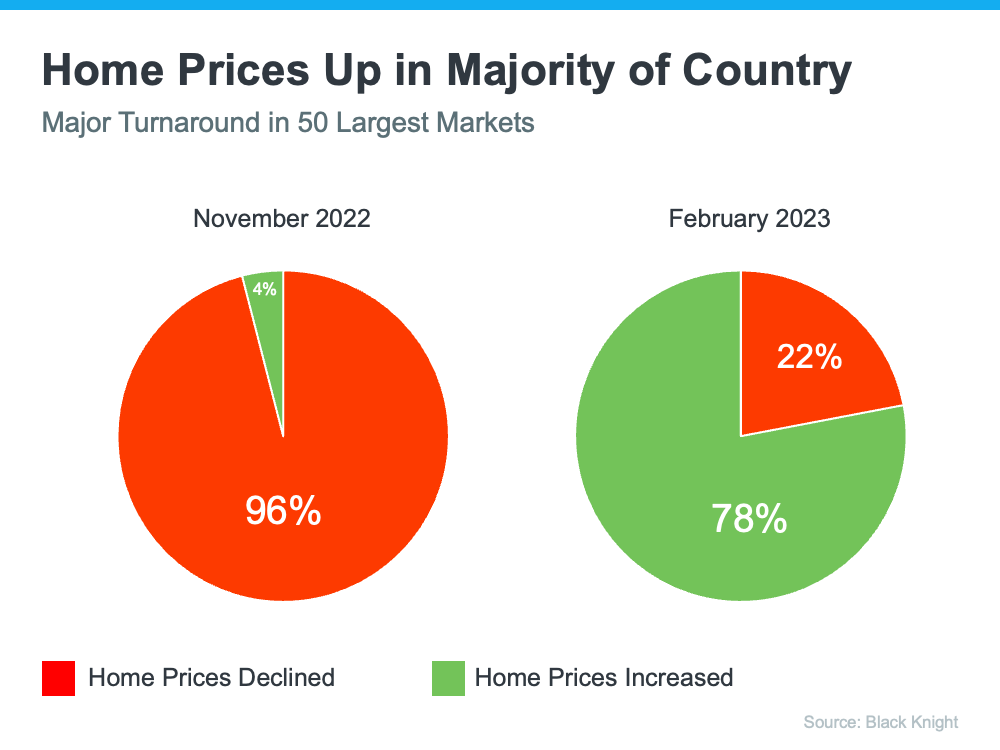

And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February:

So, should you keep waiting to buy a home until prices come down? If you factor in what the experts are saying, you probably shouldn’t. The data shows prices are increasing in much of the country, not decreasing. And the latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023.

Second, even if prices do drop, it doesn’t necessarily mean you’ll save money. If you’re financing your purchase with a mortgage, interest rates could also go up while you’re waiting, which would offset any savings you might get from a lower purchase price. Additionally, if you’re renting in the meantime, you’re still paying for housing and not building equity.

Third, waiting for lower home prices could mean missing out on the home you really want. If you find a home you love that’s within your budget, it’s worth considering making an offer even if you think prices might drop in the coming months. In a competitive market, waiting too long could mean losing out to another buyer.

Finally, buying a home is not just a financial decision. It’s also a lifestyle choice. If you’re ready to settle down and make a home for yourself, waiting for lower prices could mean delaying that process. If you have a growing family, waiting too long could mean missing out on the perfect home that meets all your needs.

Of course, it’s important to be financially savvy when buying a home. You should always do your research and make sure you’re getting a fair price for the property you’re interested in. But if you’re waiting for lower home prices, it’s worth thinking twice about whether it’s the best strategy for you. In many cases, it might make more sense to focus on finding the right home at a price you can afford, rather than trying to time the market. The best way to understand what home values are doing in your area is to work with a local real estate professional who can give you the latest insights and expert advice.

SOURCE: https://www.mykcm.com/blog/think-twice-before-waiting-for-lower-home-prices

Leave a comment